Internet Based Trading

What is Internet Based Trading (IBT) ?

Internet based trading and mobile trading helps member clients to trade on the exchange trading system by assessing member’s IBT server or mobile trading server via Internet from anywhere across country.

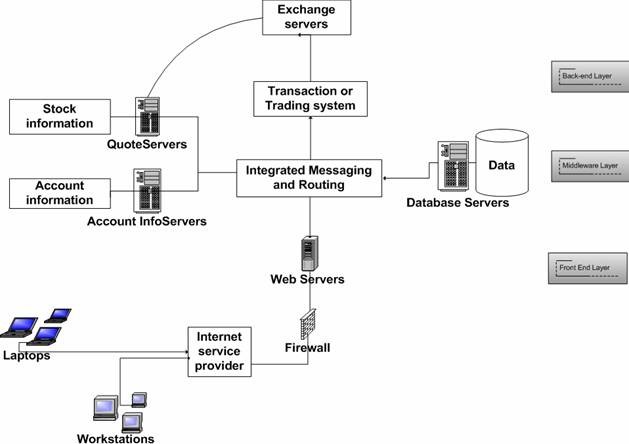

IBT Server Structure:-

Collateral Margin

1. Whether collection of margins from clients is required in the Capital market?

In case of Capital Market segment, Members should have a prudent system of risk management to protect themselves from client default. Margins are an important element of such a system. The risk management system should be well documented and be made accessible to the clients and the Exchange / NSCCL. However, the quantum of margins and the form and mode of collection of margins is left to the discretion of Members.

2. Whether collection of margins from clients is required in the F&O segment and Currency segment?

In the F&O segment, it is mandatory for Members to collect initial margins from respective clients / constituents on an upfront basis. Similarly in the Currency Derivatives segment also, it is mandatory for members to collect initial margins and extreme loss margins from their client / constituents on an upfront basis

3. In what form should a member collect margin from its constituents?

In the F&O segment, it is mandatory for Members to collect initial margins from respective clients / constituents on an upfront basis. Similarly in the Currency Derivatives segment also, it is mandatory for members to collect initial margins and extreme loss margins from their client / constituents on an upfront basis

- Free and unencumbered Balances (funds and securities) available with the member of respective client in different segments of the Exchange *.

- Bank guarantee received towards margin, issued by any approved bank and discharged in favor of the Member.

- Fixed deposit receipts (FDRs) received towards margin issued by any approved bank and lien marked in favor of the Member.

- Securities in dematerialized form actively traded on the National Exchanges, not declared as illiquid securities by any of such Exchanges. (List of illiquid securities are declared on a regular basis by the Exchanges) with appropriate hair cut.

- Units of liquid mutual funds in dematerialized form, whose NAVs are available and which could be liquidated readily with appropriate hair cut.

- Government securities and Treasury bills in electronic form with appropriate hair cut.

- Free and unencumbered Balances (funds and securities) available with the member of respective client in different segments of any Stock Exchange, with specific authorization from the client, subject to certification by independent Chartered Accountant.

- Securities given as margin which are sold in the cash market and the securities are in the pool account of the Trading Member but are not given as early pay in towards an obligation to deliver shares in the Capital Market Segment, benefit of margin be given to the client till T+1 day from the sale of securities without any hair cut.

FAQ

REMATERIALIZATION

1. What is rematerialization?

Rematerialization is the process of converting securities held in electronic form in a demat account in to paper form i.e. physical certificates.

2. What is the procedure for rematerialization?

- A BO who wishes to have his dematerialised holdings of securities rematerialized has to submit duly signed Rematerialization Request Form (RRF) to his DP. RRF can be signed by the POA holder also if any POA has been given. The POA must be registered with the Issuer/RTA

- On verification of the form, DP will generate the remat request in the system and will send it to Issuer/ RTA. On confirmation by the Issuer/ RTA, the balance will be debited from BO’s demat account.

- The Issuer/ RTA then issues securities in physical form to the BO directly.

3. Is it possible to rematerialize lock-in securities held in a demat account?

Yes. Lock-in securities in a demat account can be rematerialized. If a BO has free as well as lock-in securities in his account for an ISIN then a separate RRF is to be submitted for rematerialization of free quantity and quantity under lock-in. If lock-in balance is for different lock-in reasons or different lock-in expiry dates then a separate RRF is to be submitted for each lock-in reason / lock-in expiry date combination.

4. In case of request for rematerialization, does one get back the same certificate(s) that was dematerialized?

No. The Issuer / RTA will issue new certificate(s). The new certificate/s may be issued under new folio number or in the existing folio, if investor already has one with the company.

5. If the physical certificate issued on rematerialization has some mistake in the name or any other details, whom should the investor contact?

The Issuer or RTA, should be contacted in case of mistake in the name or any other details in the physical certificate issued. 6. Does the rematerialization attract any stamp duty? No. Remat does not amount to transfer and does not attract any stamp duty.

Source:-CDSL